Vocabulary Builder Activity

Students will learn the following key terms and phrases:

Reading Activity: Tax Accounting vs GAAP

Students will be able to correctly answer true/false questions after reading and listening to topical short articles and dialogs featuring topical vocabulary.

In the 21st century many laws and regulations have been standardized but there are still some standards which are specific to each country. If you work in accounting in the US you will have heard of and understand tax accounting, but your European counterpart will have no idea what it is. Unlike a lot of countries where the generally accepted accounting principles (GAAP) is the only method for… Continue

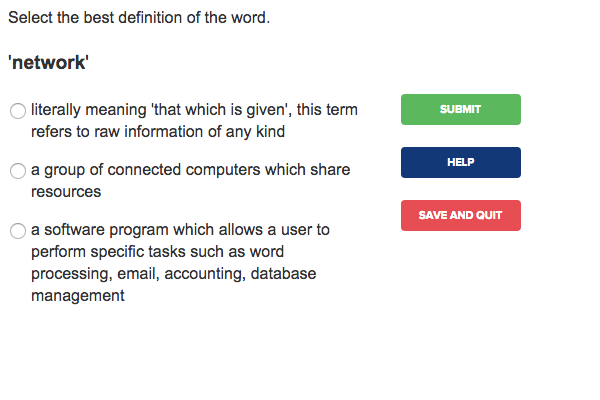

Multiple Choice Activity

Students will be able to select the best match between unit terms and their definitions.

You must sign in to try this activity.

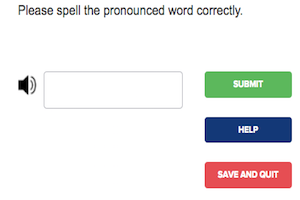

Listening Comprehension Activity

Students will be able to listen to short audio clips in English and then spell them correctly.

You must sign in to try this activity.

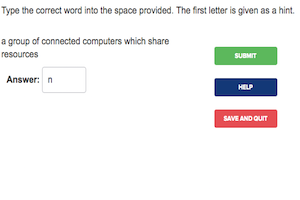

Spelling and Recognition

Students will be able to identify and spell a vocabulary term correctly given only the definition.

You must sign in to try this activity.

Speaking Practice Activity

Students will be able to speak and record 5 example sentences from the unit vocabulary and then submit them for grading by the classroom teacher. If no teacher is available or desired, then the students will be shown good examples of other students' work.

You must sign in to try this activity.

Writing Practice Activity

Students will write a short essay to be graded by the teacher. If no teacher is available or desired, then the student is shown previous examples of other writings by students.

You must sign in to try this activity.